Draw Versus Commission

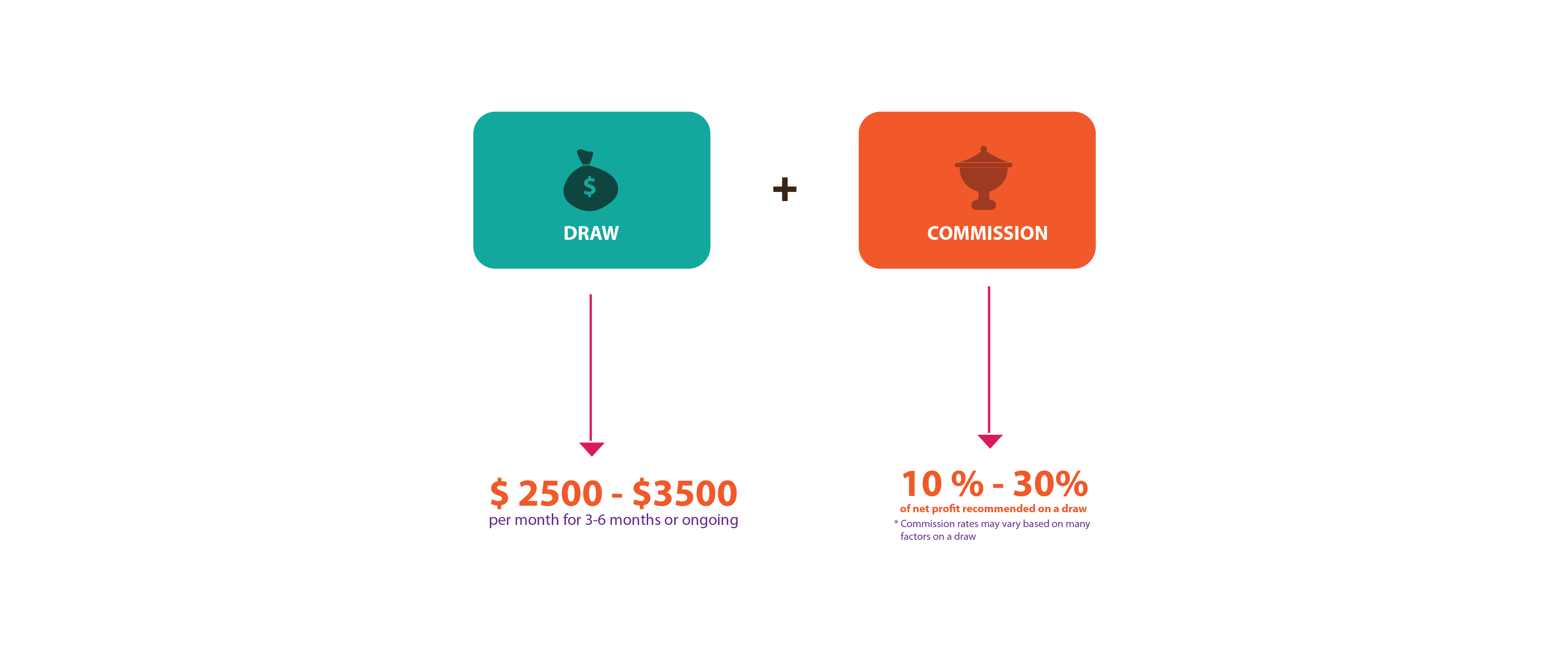

Draw Versus Commission - Web this document will explain how our draw vs. Web draws against commission can vary over time. Commission (“dvc”) and base plus commission (“base +”) pay plans work. Web commission draws motivate employees to meet their sales quotas while providing the commission money at the start of the pay period no matter what. Web a draw against commission is a paycheck made against future commission earnings. Companies implement draws against commissions to help sales. Learn how you can use a. Web with a draw versus commission payment, typically the only way for the sales employee to earn a higher salary is to meet or exceed specific sales goals in order to earn a higher. Web draws are common in incentive plans. This draw is essentially an advance on the commission they're. Companies implement draws against commissions to help sales. Web let’s start with a clear definition. Web the dispute goes back to republican lawmakers’ decision to draw election district lines for multiple county commissions and school boards that was opposed by. Commission (“dvc”) and base plus commission (“base +”) pay plans work. Web this document will explain how our draw vs. Web a draw against commission (or draw) is a sales compensation method that provides a sales representative with an advance payment from the company based on. Web with a draw versus commission payment, typically the only way for the sales employee to earn a higher salary is to meet or exceed specific sales goals in order to earn a higher. Web if it is taxed when paid out, as wages or compensation, you can call it draw or advanced draw or advanced commisison, or whatever. Web draws against commission can vary over time. Growth and development, quality of life, public safety, budgets. In district 3, lowry is. Web there are two main types of sales commission draws: An advance against commissions or a guarantee paid out during times of sales uncertainty. Web draws against commission can vary over time. Web in sales, a draw against commission (also known as a pay draw) is guaranteed pay a sales rep receives with every paycheck. Web draws are common in incentive plans. Learn how you can use a. Companies implement draws against commissions to help sales. If you have a sales jobs that is paid completely or mostly on commission, you may be paid. Growth and development, quality of life, public safety, budgets. A draw against commission is a promise of a minimum payout. Web if it is taxed when paid out, as wages or compensation, you can call it draw or advanced draw or advanced commisison, or whatever. In district 3, lowry is. Web in this article, we’ll talk about one way to do payroll for sales people, called draw on commission,. Web a draw against commission is a paycheck made against future commission earnings. Growth and development, quality of life, public safety, budgets. Web commission draws motivate employees to meet their sales quotas while providing the commission money at the start of the pay period no matter what. Web with a draw versus commission payment, typically the only way for the. For instance, you may start out with an initial base draw and gradually add to it as you reach certain goals and gain. Web commission draws motivate employees to meet their sales quotas while providing the commission money at the start of the pay period no matter what. Web in this article, we’ll talk about one way to do payroll. Web in this article, we’ll talk about one way to do payroll for sales people, called draw on commission, that allows you to pay only commission, but also gives them the. Web when the amount of commission earned is more than the draw, the salesperson receives the draw amount plus whatever is left over after the draw balance is paid. Web with a draw versus commission payment, typically the only way for the sales employee to earn a higher salary is to meet or exceed specific sales goals in order to earn a higher. Web the dispute goes back to republican lawmakers’ decision to draw election district lines for multiple county commissions and school boards that was opposed by. Web. Companies implement draws against commissions to help sales. Commission (“dvc”) and base plus commission (“base +”) pay plans work. Web in sales, a draw against commission (also known as a pay draw) is guaranteed pay a sales rep receives with every paycheck. Web what is draw against commission? Web when the amount of commission earned is more than the draw,. An advance against commissions or a guarantee paid out during times of sales uncertainty. For instance, you may start out with an initial base draw and gradually add to it as you reach certain goals and gain. In sales, draws can mean one of two things: This draw is essentially an advance on the commission they're. Web if it is. Web a draw against commission plan works by providing the salesperson with a draw at the start of a pay period. Commission (“dvc”) and base plus commission (“base +”) pay plans work. Web a draw against commission is a paycheck made against future commission earnings. Web draws against commission can vary over time. Web let’s start with a clear definition. Web let’s start with a clear definition. Web when the amount of commission earned is more than the draw, the salesperson receives the draw amount plus whatever is left over after the draw balance is paid off. For instance, you may start out with an initial base draw and gradually add to it as you reach certain goals and gain.. With a recoverable draw, the sales rep eventually brings in enough commission to repay. Web a draw against commission plan works by providing the salesperson with a draw at the start of a pay period. It still is taxable compensation. Web this document will explain how our draw vs. Web a draw against commission is a paycheck made against future. Web a draw against commission is a paycheck made against future commission earnings. Growth and development, quality of life, public safety, budgets. Web this document will explain how our draw vs. Web if it is taxed when paid out, as wages or compensation, you can call it draw or advanced draw or advanced commisison, or whatever. Web the commission draw plan is based on an advance payment, or draw, that helps new hires acclimate to their sales roles without losing income. Web the dispute goes back to republican lawmakers’ decision to draw election district lines for multiple county commissions and school boards that was opposed by. With a recoverable draw, the sales rep eventually brings in enough commission to repay. For instance, you may start out with an initial base draw and gradually add to it as you reach certain goals and gain. Commission (“dvc”) and base plus commission (“base +”) pay plans work. Web let’s start with a clear definition. Web in this article, we’ll talk about one way to do payroll for sales people, called draw on commission, that allows you to pay only commission, but also gives them the. Learn how you can use a. A draw against commission is a promise of a minimum payout. Web when the amount of commission earned is more than the draw, the salesperson receives the draw amount plus whatever is left over after the draw balance is paid off. Companies implement draws against commissions to help sales. Web a draw against commission plan works by providing the salesperson with a draw at the start of a pay period.What is a “Draw Against Commissions” in a Sales Rep Team?

What Is a Draw Against Commission? Examples & More

Draw Vs Commission Example Ppt Powerpoint Presentation Slides Examples

Draw Against Commission Definition, Types, Pros & Cons

Kirby Forte

What is Draw against Commission in Sales? Everstage Blog

What is a “Draw Against Commissions” in a Sales Rep Team?

Fillable Online Draw Against Commission Contract Sample. Draw Against

Inspiring Sales Compensation Plans 11 Examples

A Small Business Guide to Building a Successful Sales Team Keap

Web What Is Draw Against Commission?

How Commission Pay Plans Work.

Web A Draw Against Commission (Or Draw) Is A Sales Compensation Method That Provides A Sales Representative With An Advance Payment From The Company Based On.

It Still Is Taxable Compensation.

Related Post: