Drawer On Cheque

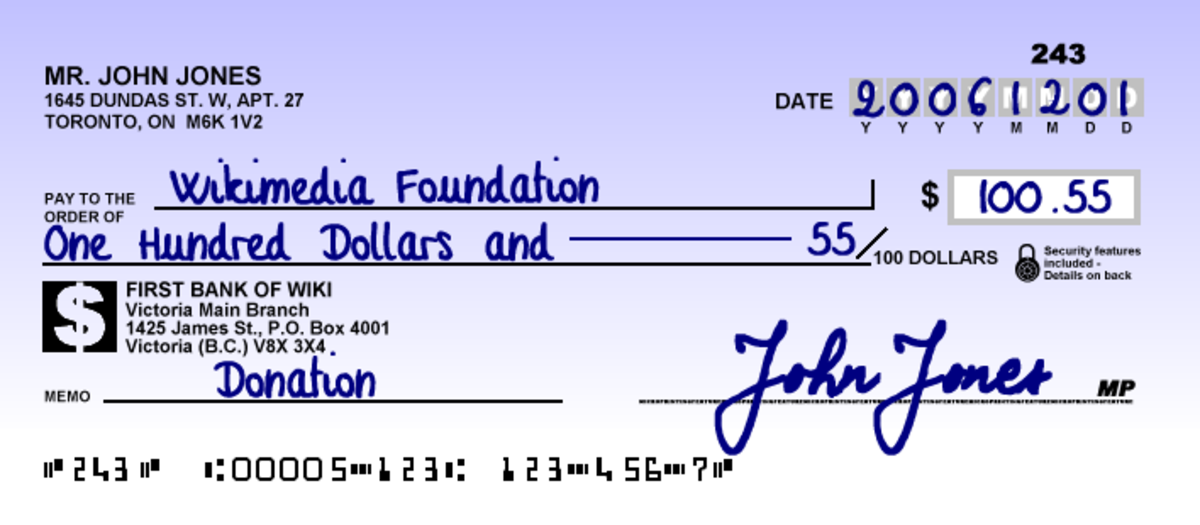

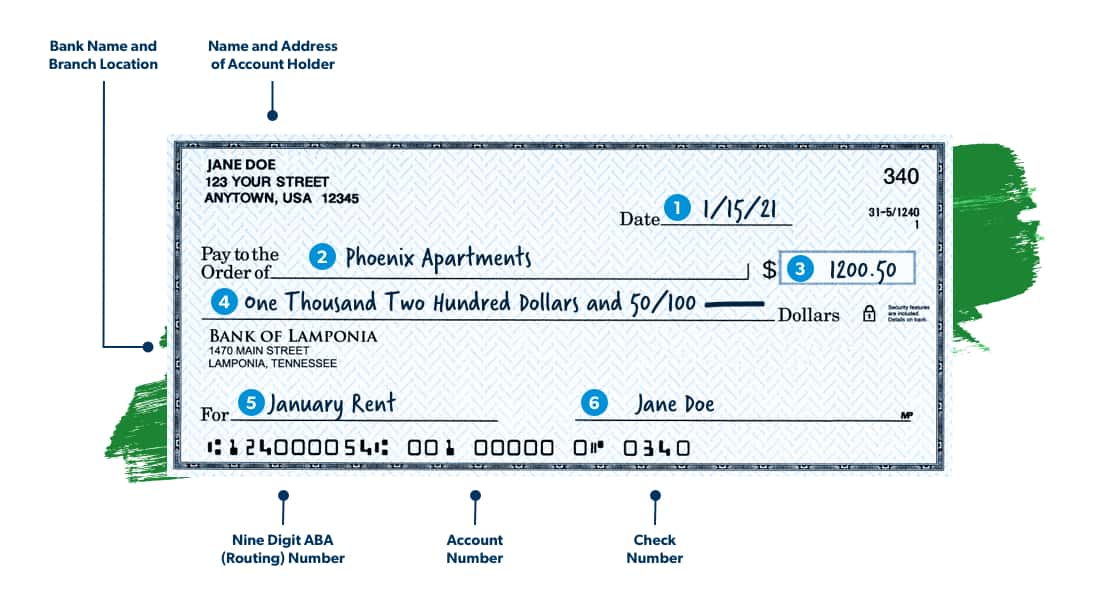

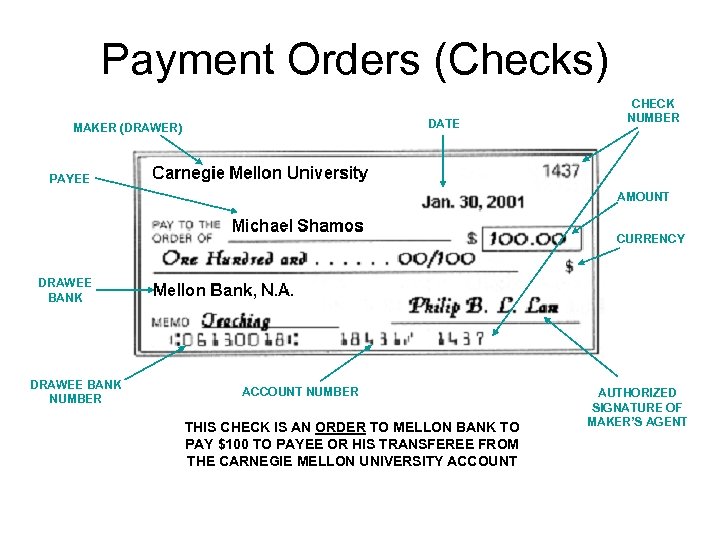

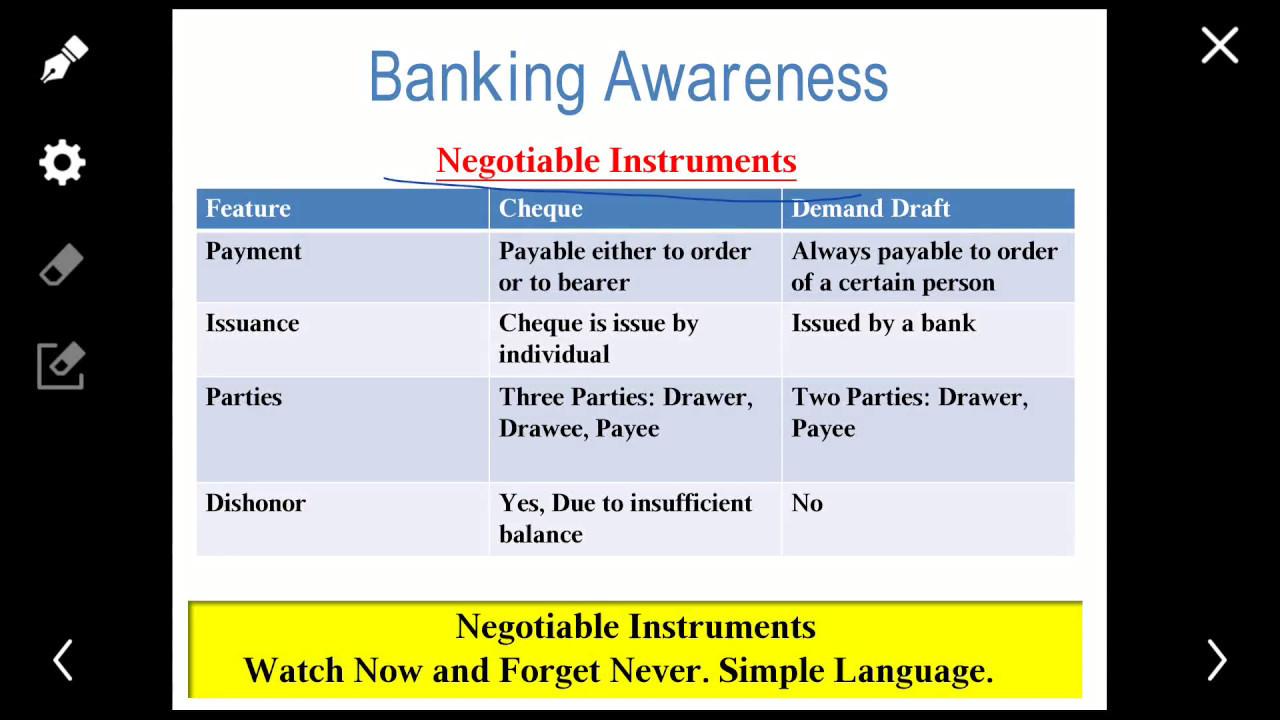

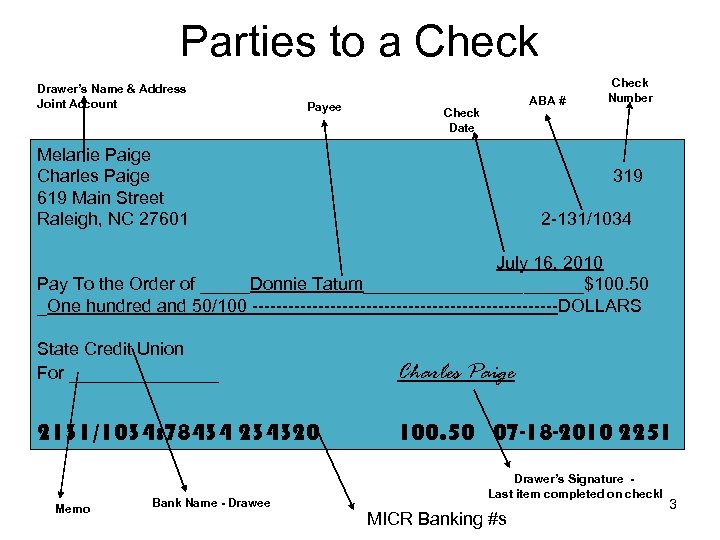

Drawer On Cheque - The bank on which the cheque is drawn or who is directed to pay the specified sum written on the cheque. Apart from these, there can also be a. Web the four main items on a cheque are: I’ve created this sample and labeled all the parts so you can learn how to understand a check. The primary role of a drawee is to redirect funds from the payor’s account to the payee’s account. The person or entity to whom the cheque is addressed, indicating who will receive the payment. The person who draws a cheque is called the ‘drawer’. These include the drawer and the drawee. He is person who issue’s the cheque. The person or entity who is to be paid the amount. The drawee is the entity, usually a financial institution, responsible for honoring the check and distributing funds to the person presenting it, known as the payee. In case of dishonour of cheque or bill of exchange by the drawee or the acceptor, the drawer of such cheque or bill of exchange needs to compensate the holder such amount. The person or entity whose transaction account is to be drawn. The acceptor is the person or other organization that pays the check owner, the check maker is the drawer, and the check recipient is the payee. He is also called as maker or issuer of the cheque. The person who draws the cheque, i.e. Web the drawer of a cheque has significant responsibilities and liabilities, especially in the event of a dishonor. Web the payor, or drawer, is the individual with the funds who issues a check. The drawer writes the cheque in the name of the beneficiary, requesting the bank to transfer the mentioned amount to the beneficiary from their account. Web understanding check format helps you set up direct deposit instructions, make sure checks you receive are filled in properly, and order new checks. Web drawee is the party that has been ordered by the drawer to pay a certain sum of money to the person presenting the check (the payee). Web drawer means a person who signs a cheque or a bill of exchange ordering his or her bank to pay the amount to the payee. The bank on which the cheque is drawn or who is directed to pay the specified sum written on the cheque. The person who draws a cheque is called the ‘drawer’. It represents the bank that will make the payment. Web the four main items on a cheque are: The person or entity whose transaction account is to be drawn. It is the party to whom the money specified in the cheque is payable. Web a drawee is the person or entity that pays the holder of a check or draft. Web the basic difference between cheque and demand draft is that a cheque is issued by a bank customer, whereas a demand draft is issued by the bank on application. Web the words 'or bearer' mean that the bank on which the cheque is drawn is entitled to pay the cheque to the person in possession of the cheque, even if that person found it or stole it, unless the bank has reason to suspect that the cheque has fallen into the wrong hands. Signs and orders the bank to. Web a drawee refers to the person or organization that’s ordered to pay a certain sum of money to a payee. Web there are several sections on a check and they are all important. Both types of checks provide greater security and assurance to the payee compared to a regular personal check. The drawer writes the cheque in the name. Drawer and payee can be the same person if it is a self cheque. The drawer writes the cheque in the name of the beneficiary, requesting the bank to transfer the mentioned amount to the beneficiary from their account. He is also called as maker or issuer of the cheque. Web the drawer of a cheque has significant responsibilities and. Both types of checks provide greater security and assurance to the payee compared to a regular personal check. Web whether it's a cheque, a bill of exchange, or a promissory note, the drawer is the party responsible for creating and issuing the instrument. Both the instruments, cheque and demand drafts have their own uses and limitations. While the drawer is. The person or entity who is to be paid the amount. It is the party to whom the money specified in the cheque is payable. Web basically, there are three parties to a cheque: Signs and orders the bank to pay the sum. The primary role of a drawee is to redirect funds from the payor’s account to the payee’s. Web a drawee refers to the person or organization that’s ordered to pay a certain sum of money to a payee. Web understanding check format helps you set up direct deposit instructions, make sure checks you receive are filled in properly, and order new checks. These include the drawer and the drawee. The person who draws the cheque, i.e. Web. Web a drawee refers to the person or organization that’s ordered to pay a certain sum of money to a payee. Usually, the drawee is the bank. Web understanding check format helps you set up direct deposit instructions, make sure checks you receive are filled in properly, and order new checks. Web drawee is the party that has been ordered. The person or entity whose transaction account is to be drawn. The main parts of a check include personal information, bank information, the. The person who writes the cheque, instructing the bank to make the payment. Usually, the drawer's name and account is preprinted on the cheque, and the drawer is usually the signatory. Understanding the role of the drawer. It is the party to whom the money specified in the cheque is payable. Web the drawer of a cheque has significant responsibilities and liabilities, especially in the event of a dishonor. Both types of checks provide greater security and assurance to the payee compared to a regular personal check. Signs and orders the bank to pay the sum. The. Web a check is a written, dated, and signed draft that directs a bank to pay a specific sum of money to the bearer. While the drawer is the person who draws the cheque, the drawee is the banker on whom it is drawn. The person or entity writing the check is known as the payor or drawer, while. Drawer. The holder of the check is the payee and the check writer is the drawer. Both the instruments, cheque and demand drafts have their own uses and limitations. Web the drawer of a cheque has significant responsibilities and liabilities, especially in the event of a dishonor. Drawee or payor bank, the bank which has the drawer’s account from which the cheque is to be paid. Web drawer means a person who signs a cheque or a bill of exchange ordering his or her bank to pay the amount to the payee. The person or entity writing the check is known as the payor or drawer, while. It is vital for the drawer to understand these obligations to avoid legal repercussions, which can range from fines to imprisonment. The bank on which the cheque is drawn or who is directed to pay the specified sum written on the cheque. Signs and orders the bank to pay the sum. He is also called as maker or issuer of the cheque. Web understanding check format helps you set up direct deposit instructions, make sure checks you receive are filled in properly, and order new checks. The person or entity who is to be paid the amount. Both types of checks provide greater security and assurance to the payee compared to a regular personal check. Web whether it's a cheque, a bill of exchange, or a promissory note, the drawer is the party responsible for creating and issuing the instrument. Web a check is a written, dated, and signed draft that directs a bank to pay a specific sum of money to the bearer. Web anatomy of a cheque:How to Write a Check Cheque Writing 101 HubPages

Design 40 of Who Is The Drawer Of A Bank Cheque valleyinspectionspestinc

Detailed Guide On How To Write A Check

Drawer Drawee & Payee Parties on Cheque Difference Between Drawer

Banking and Foreign Exchange Slides by M Shamos

Drawer And Drawee Of A Cheque Bruin Blog

Drawer And Drawee Of A Cheque Bruin Blog

Drawer And Drawee Of A Cheque Bruin Blog

Cheque “Drawer” does not Include Authorised Signatory of Company u/s

Common Payment Services — EFT Electronic Funds Transfer

Web A Drawee Refers To The Person Or Organization That’s Ordered To Pay A Certain Sum Of Money To A Payee.

Usually, The Drawee Is The Bank.

The Person Or Entity Whose Transaction Account Is To Be Drawn.

Drawer And Payee Can Be The Same Person If It Is A Self Cheque.

Related Post: