Reconcile Cash Drawer

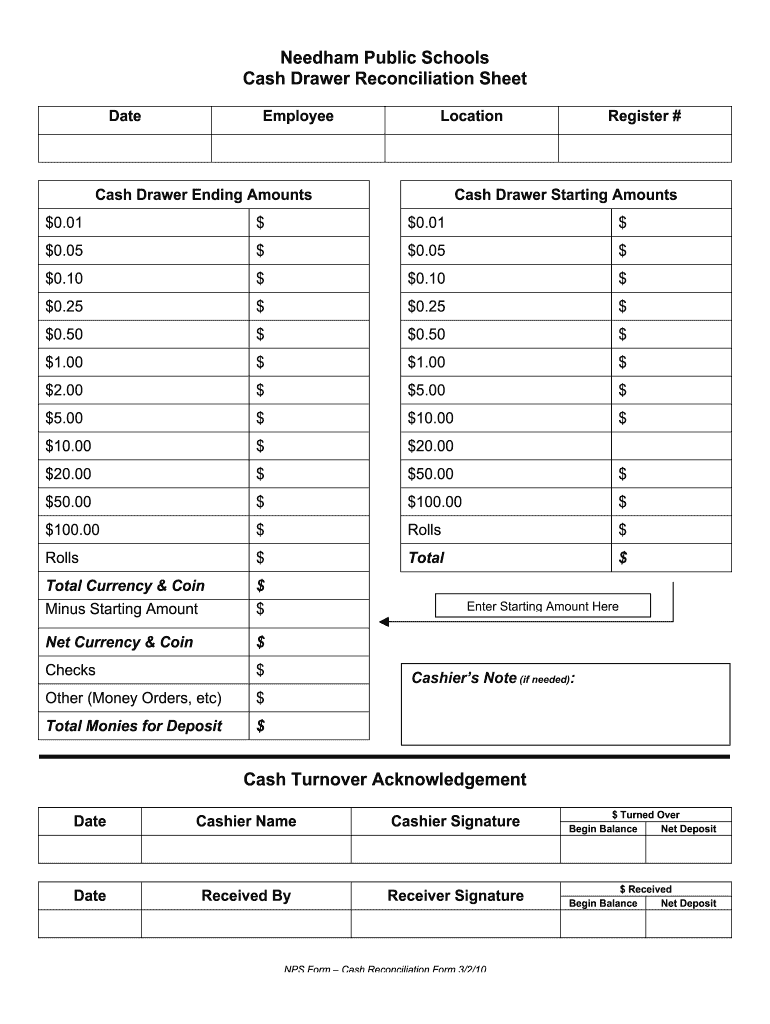

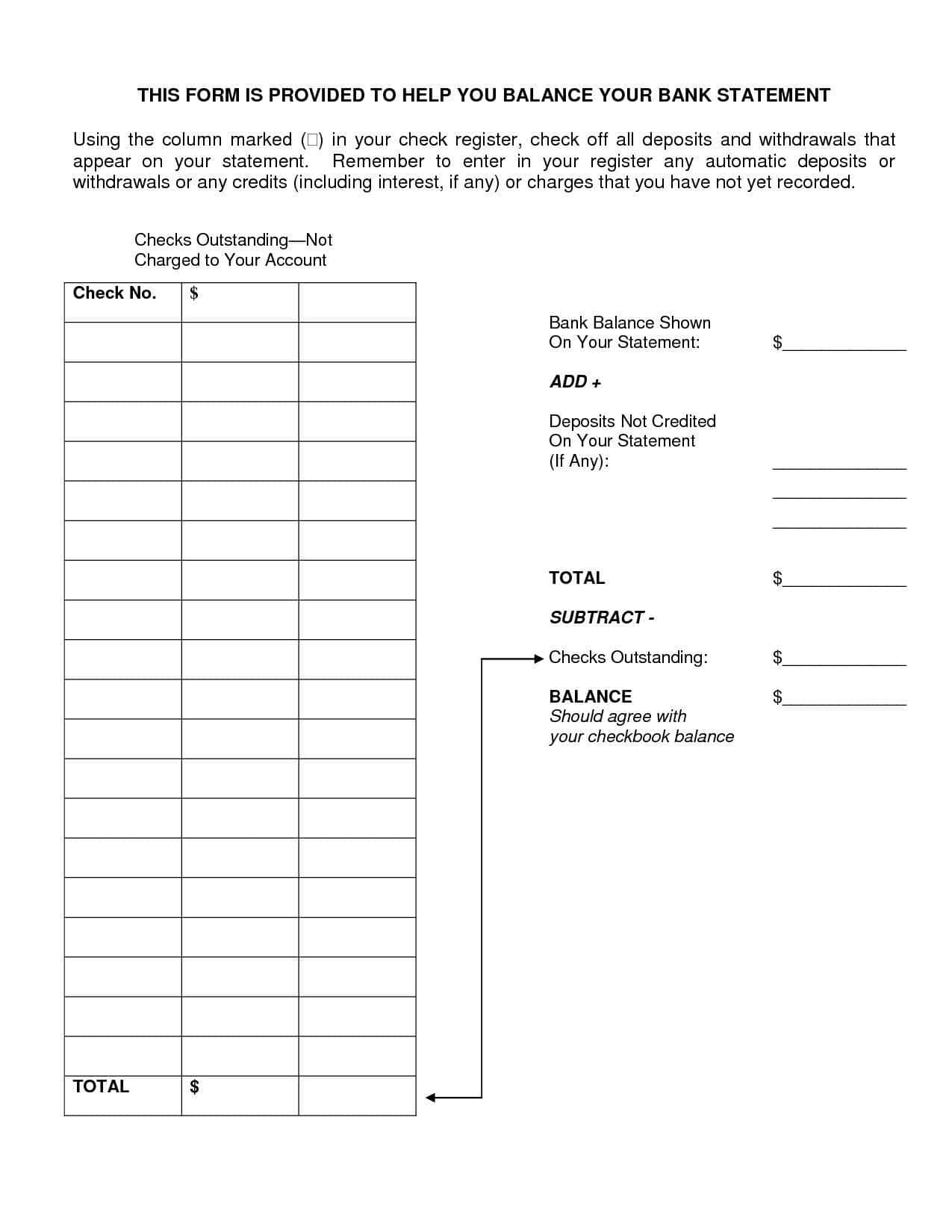

Reconcile Cash Drawer - Purchases made with money drawn from petty cash are expenses. Web what do you do? Determine the accounting period that is being reconciled. Write an iou for $215 to the server and pay them out when you go to the bank and get the safe back up to. Why should you balance your cash drawer? To provide exceptional customer service and resolve issues promptly; Web to manage and reconcile cash drawers and transaction reports; The verification can also take place whenever a different clerk takes over a cash register. All sales transactions that occurred within the. This is an important skill for both managers and any staff who will be handling the cash register to have. Here, we break down why it’s important to—and how you can—balance your cash drawer like a pro. Money held in the cash box is an asset. It’s part of your business’s financial records. All sales transactions that occurred within the. March 8, 2017 2 min read. The verification can also take place whenever a different clerk takes over a cash register. Web cash drawer reconciliation sheet template. It’s a critical internal control mechanism to prevent and detect errors and fraud. Determine the accounting period that is being reconciled. Instituting a policy to count down cash drawers helps to reduce the. Best practices for managing multiple cash drawers; Web what do you do? Here, we break down why it’s important to—and how you can—balance your cash drawer like a pro. Web if you run or work in any sort of establishment that has a cash register, you will want to learn how to reconcile your cash drawer. Web if you usually put money in your cash drawer without thinking, you’re not helping yourself. Assign one person per drawer; Why should you balance your cash drawer? All sales transactions that occurred within the. A manager would then perform a reconciliation of the count to see if all tendered payments match what the cashier had entered. Web a cash reconciliation is the process of verifying the amount of cash in a cash register as of the close of business. A manager would then perform a reconciliation of the count to see if all tendered payments match what the cashier had entered. Web cash reconciliation is the process of verifying that sales transactions recorded at the point of sale (pos) system align with the actual cash, checks, and other methods of payment received. Purchases made with money drawn from petty. Web cash reconciliation is the process of verifying that sales transactions recorded at the point of sale (pos) system align with the actual cash, checks, and other methods of payment received. Web reconciling your cash drawer with your supervisor or manager is a crucial step to verify your performance, prevent errors, and detect fraud. Web if you usually put money. As long as there is money in the drawer, they’re good. March 8, 2017 2 min read. There are a few ways to reconcile this and each establishment will have their own systems to account for this. To provide exceptional customer service and resolve issues promptly; Web it involves comparing the detailed amounts of receivables recorded in a company's accounting. The sheet comprises of sales of the different product to customers and the expenses made in cash during organization activities. Web cash reconciliation is a fundamental accounting practice designed to ensure the amounts recorded from sales transactions accurately reflect the cash, checks, and other payment forms collected through a point of sale (pos) system. General ledger reconciliation is pivotal for. Assign one person per drawer; Upon completing this course, delegates will have the expertise and confidence needed to perform cashier duties proficiently, ensuring accuracy in. Web what do you do? At the beginning of the next day or the following shift, recount the cash in each drawer to verify that the beginning balance is accurate. Best practices for managing multiple. As long as there is money in the drawer, they’re good. Web how to reconcile your petty cash. Web to manage and reconcile cash drawers and transaction reports; What is the purpose of reconciliation? Download reports from financial systems. Web reconciling cash means verifying that the amount of money you have in your drawer or vault matches the amount you started with and the amount recorded in your system. What is the purpose of reconciliation? This program displays the total cash, checks, and credit card amounts taken for the day, and it provides you with access to multiple detailed. As long as there is money in the drawer, they’re good. Instituting a policy to count down cash drawers helps to reduce the. To others, there is the constant worry if that is the correct amount of cash in the drawer. Upon completing this course, delegates will have the expertise and confidence needed to perform cashier duties proficiently, ensuring accuracy. What is the purpose of reconciliation? This is an important skill for both managers and any staff who will be handling the cash register to have. It’s a critical internal control mechanism to prevent and detect errors and fraud. Download reports from financial systems. This is a crucial step to. This is an important skill for both managers and any staff who will be handling the cash register to have. Web use the cash control entry program to reconcile your cash drawer. Web what do you do? Web balancing your cash drawer helps prevent, identify, and correct any cash shortages or any other discrepancies resulting from miscounts or other mistakes,. There are a few ways to reconcile this and each establishment will have their own systems to account for this. Web reconciling cash means verifying that the amount of money you have in your drawer or vault matches the amount you started with and the amount recorded in your system. Web reconciling your cash drawer with your supervisor or manager is a crucial step to verify your performance, prevent errors, and detect fraud. Here, we break down why it’s important to—and how you can—balance your cash drawer like a pro. Web if you run or work in any sort of establishment that has a cash register, you will want to learn how to reconcile your cash drawer. General ledger reconciliation is pivotal for ensuring financial accuracy by comparing ledger balances with external documents like bank statements and invoices. Web have employees who manage cash drawers sign a report indicating they balanced the drawer. To adhere to best practices and company policies in cashiering; It’s a critical internal control mechanism to prevent and detect errors and fraud. The verification can also take place whenever a different clerk takes over a cash register. This process helps in identifying any discrepancies, such as unrecorded payments, billing errors, or overlooked invoices. Web balancing your cash drawer helps prevent, identify, and correct any cash shortages or any other discrepancies resulting from miscounts or other mistakes, so you can keep accurate records of your cash sales. Web cash reconciliation is the process of verifying that sales transactions recorded at the point of sale (pos) system align with the actual cash, checks, and other methods of payment received. In this article, we will explain how to reconcile. All sales transactions that occurred within the. Write an iou for $215 to the server and pay them out when you go to the bank and get the safe back up to.Cash drawer reconciliation sheet Fill out & sign online DocHub

How to Reconcile a Cash Drawer Career Trend

Free Printable Cash Drawer Count Sheet

How to Reconcile the Cash Drawer in ME YouTube

Excel Templates Cash Drawer Reconciliation Sheet Cash Register

Sample, Example & Format Templates Cash Drawer Reconciliation Sheet

Excel Templates Cash Drawer Reconciliation Sheet Cash Register

NPS Cash Drawer Reconciliation Sheet 20102022 Fill and Sign

Free Printable Cash Drawer Count Sheet

Sample, Example & Format Templates Cash Drawer Reconciliation Sheet

Determine The Accounting Period That Is Being Reconciled.

Purchases Made With Money Drawn From Petty Cash Are Expenses.

The Most Common Solution I’ve Seen Is To Write An Iou:

Web How To Perform A Cash Reconciliation.

Related Post: