Tariff Drawing

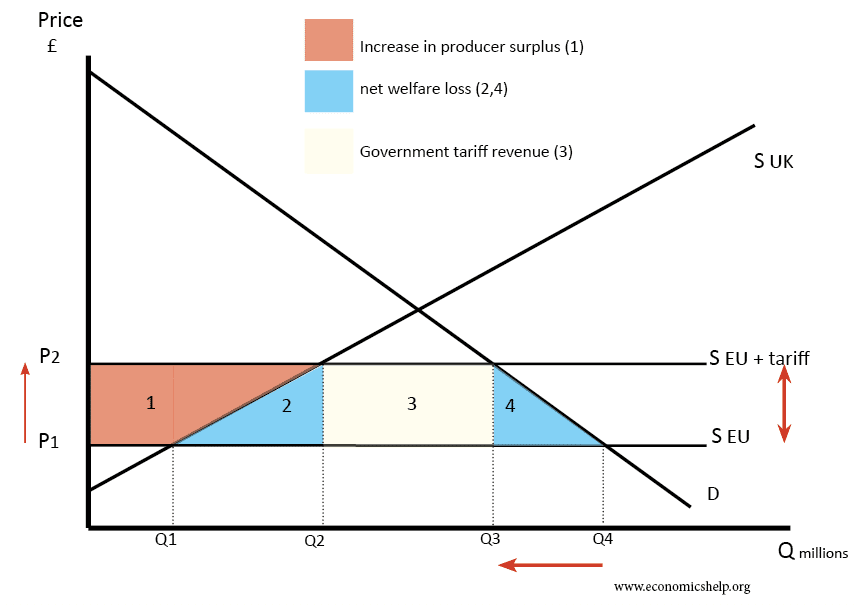

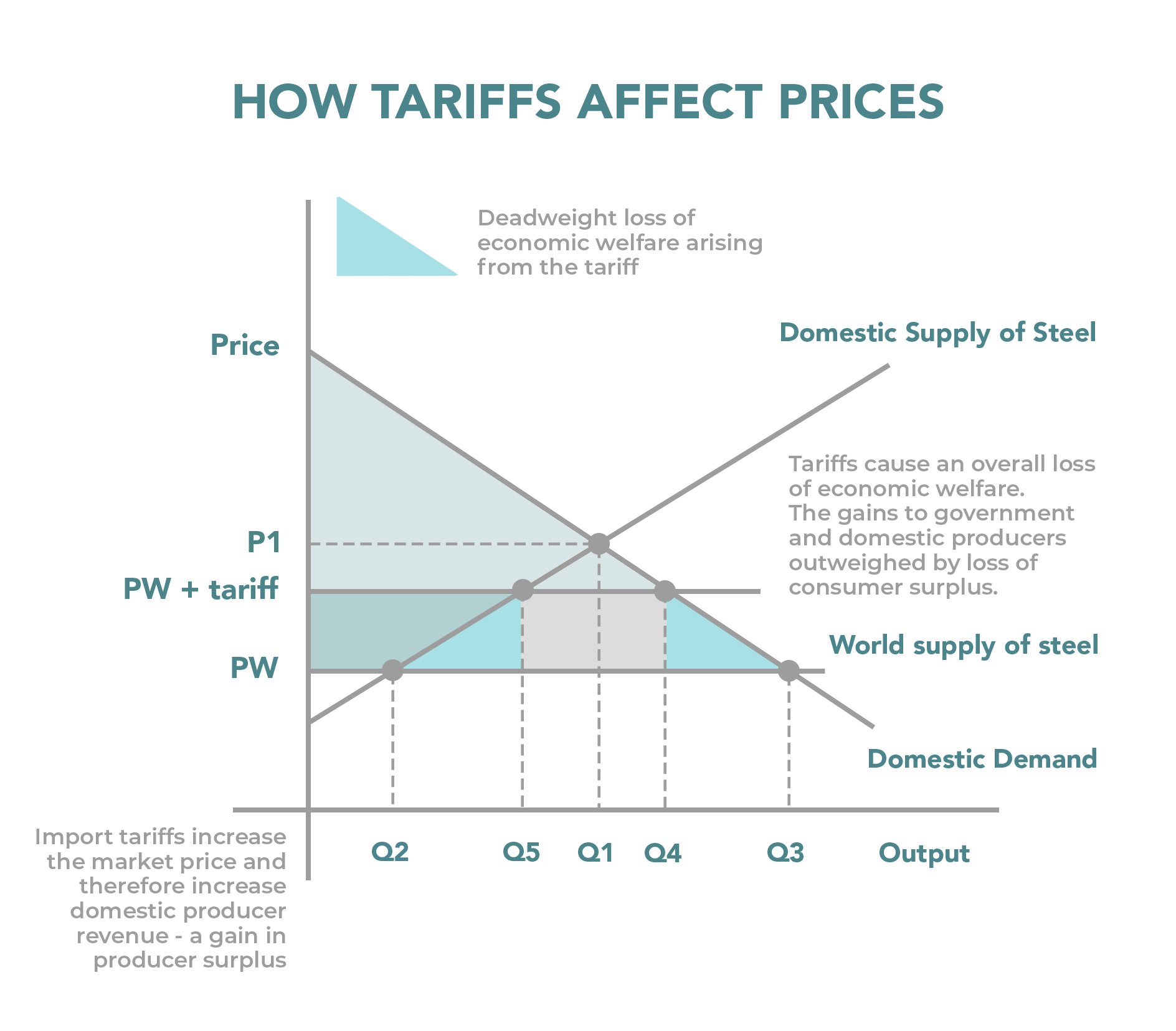

Tariff Drawing - Web who gains and who loses from a tariff? Meanwhile, a hole allows the admission of u.s. Web what are tariffs and how do they affect consumers, firms and the economy? Modeling the effects of trade policy. How do we get utility tariffs? The magnitude of optimum tariff depends upon the elasticity of foreign offer curve. What tariff options are there? What are the principles of tariff design? So what are tariffs, and how do they work? This set of interactive questions helps students understand changes in consumer and producer surplus due to a tariff. Web explain the impact of tariffs to domestic consumers, producers, and government; Web there’s almost nothing more contentious in the world of trade than tariffs. Web a tariff is a tax levied on an imported good with the intent to limit the volume of foreign imports, protect domestic employment, reduce competition among domestic industries, and increase government revenue. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and policy that taxes foreign products to encourage or safeguard domestic industry. Web tariff diagram and examples | economic analysis, including as, ad and essay plan | key evaluation points | weaknesses of the standard tariff model and more. Web search for import and export commodity codes and for tax, duty and licences that apply to your goods. The magnitude of optimum tariff depends upon the elasticity of foreign offer curve. In this video we walk through the basic effects of an import tariff applied to a product (steel) where the world supply price is lower than would normally be charged in a domestic market without trade. A european worker sitting on top of the pile gives a gallic shrug, while joe stalin in the background smiles. Quotas or ‘voluntary export restrictions’. There are two types of tariffs. Tariffs may be levied either to raise revenue or. Web the harmonized tariff schedule of the united states (hts) sets out the tariff rates and statistical categories for all merchandise imported into the united states. Web explain the impact of tariffs to domestic consumers, producers, and government; An explanation of tariffs with diagrams to explain who are the winners and losers from tariffs. Web the increases in power tariffs were needed to meet conditions set by the imf for a $7 billion loan deal made earlier this month. In the course so far, we have modeled trade in general equilibrium: The hts is based on the international harmonized system, which is the global system of nomenclature applied to most world trade in goods. This set of interactive questions helps students understand changes in consumer and producer surplus due to a tariff. Web tariff diagram and examples | economic analysis, including as, ad and essay plan | key evaluation points | weaknesses of the standard tariff model and more. Suppose that it faces a world price of the good of $4 per pound. Use creately’s easy online diagram editor to edit this diagram, collaborate with others and export results to multiple image formats. They’ve been around for as long as people have been trading goods across seas and states. Protests over skyrocketing power bills shut down a major road. To this day, economists debate their exact effect on economic growth. How can customers get involved in tariff design? Understand and show why a tariff causes a deadweight loss Web let us first discuss the impact of tariff on production and consumption. They’ve been around for as long as people have been trading goods across seas and states. Meanwhile, a hole allows the admission of u.s. Web tariff diagram and examples | economic analysis, including as, ad and essay plan | key evaluation points | weaknesses of the standard tariff model and more. This set of interactive questions helps students understand changes in consumer and producer surplus due to a tariff. Besides being a source of revenue for. I) gathering information about operator’s activity and demand forecasts, ii) evaluating the effectiveness of the current tariff structure and the need for reform; To this day, economists debate their exact effect on economic growth. They’ve been around for as long as people have been trading goods across seas and states. Web the harmonized tariff schedule of the united states (hts). Web learn how to apply the concepts of supply and demand, consumer surplus, dead weight loss, and tariff revenue to international trade and tariffs. Web a tariff is a charge levied on goods as they enter a country by crossing the national customs frontier, usually their general purpose is to reduce the volumes of imports. Web tariff, tax levied upon. Web tariff diagram and examples | economic analysis, including as, ad and essay plan | key evaluation points | weaknesses of the standard tariff model and more. A european worker sitting on top of the pile gives a gallic shrug, while joe stalin in the background smiles. In the course so far, we have modeled trade in general equilibrium: Tariffs. Show the effects on this market of a 25% ad valorem tariff on the good by. Web a tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. The words ‘tariff,’ ‘duty,’ and ‘customs’ can be used interchangeably. In this video we walk through the basic effects of. Understand and show why a tariff causes a deadweight loss Web when governments impose restrictions on international trade, this affects the domestic price of the good and reduces total surplus. Web this is the optimum tariff. In the course so far, we have modeled trade in general equilibrium: What tariff options are there? Use creately’s easy online diagram editor to edit this diagram, collaborate with others and export results to multiple image formats. Web search for import and export commodity codes and for tax, duty and licences that apply to your goods. Show the effects on this market of a 25% ad valorem tariff on the good by. Web a tariff is a. I) gathering information about operator’s activity and demand forecasts, ii) evaluating the effectiveness of the current tariff structure and the need for reform; The hts is based on the international harmonized system, which is the global system of nomenclature applied to most world trade in goods. Protests over skyrocketing power bills shut down a major road into. How can customers. Understand and show why a tariff causes a deadweight loss This set of interactive questions helps students understand changes in consumer and producer surplus due to a tariff. Web a tariff is a charge levied on goods as they enter a country by crossing the national customs frontier, usually their general purpose is to reduce the volumes of imports. Trade affects all sectors in the economy. The above diagram 1 demonstrates that any tariff tends to raise the domestic price of a commodity above its free trade level and thereby stimulates domestic production and reduces domestic consumption of the commodity in question. You can easily edit this template using creately. Web this is the optimum tariff. In the course so far, we have modeled trade in general equilibrium: Web a tariff is a tax levied on an imported good with the intent to limit the volume of foreign imports, protect domestic employment, reduce competition among domestic industries, and increase government revenue. Iii) announcing the reform and iv) implementing the proposed reform (green and pardina, 1999). An explanation of tariffs with diagrams to explain who are the winners and losers from tariffs. Web explain the impact of tariffs to domestic consumers, producers, and government; To this day, economists debate their exact effect on economic growth. Web tariff, tax levied upon goods as they cross national boundaries, usually by the government of the importing country. Web who gains and who loses from a tariff? Why does tariff design matter?The Basics of Tariffs and Trade Barriers

Tariff cartoon hires stock photography and images Alamy

Effect of tariffs Economics Help

Cartoon Tariffs, 1907 Drawing by Clifford Berryman Pixels

Best Tariff Illustrations, RoyaltyFree Vector Graphics & Clip Art iStock

Tariff Definitions & Examples InvestingAnswers

Tariff Cartoon, 1879 Drawing by Thomas Nast Fine Art America

Tariff diagram YouTube

Tariff Bill Cartoon, 1883 Drawing by Bernhard Gillam Pixels

How do you draw economics tariff graphs? Part two. YouTube

A European Worker Sitting On Top Of The Pile Gives A Gallic Shrug, While Joe Stalin In The Background Smiles.

Web Search For Import And Export Commodity Codes And For Tax, Duty And Licences That Apply To Your Goods.

How Do We Get Utility Tariffs?

One Such Imposition Is A Tariff (A Tax On Imported Or Exported Goods And Services).

Related Post:

:max_bytes(150000):strip_icc()/TariffsAffectPrices2_2-f9bc0f6dc8f248eb8c6e22ad499b66c0.png)